Table of Contents

- Stimulus Payment News - Latest Stimulus Check updates and news

- Stimulus checks: When you’ll get your money and why some will have to ...

- Stimulus checks: IRS sets Wednesday deadline for economic impact ...

- Stimulus checks: When you’ll get your money and why some will have to ...

- Here’s when Americans get their stimulus check – Ya Libnan

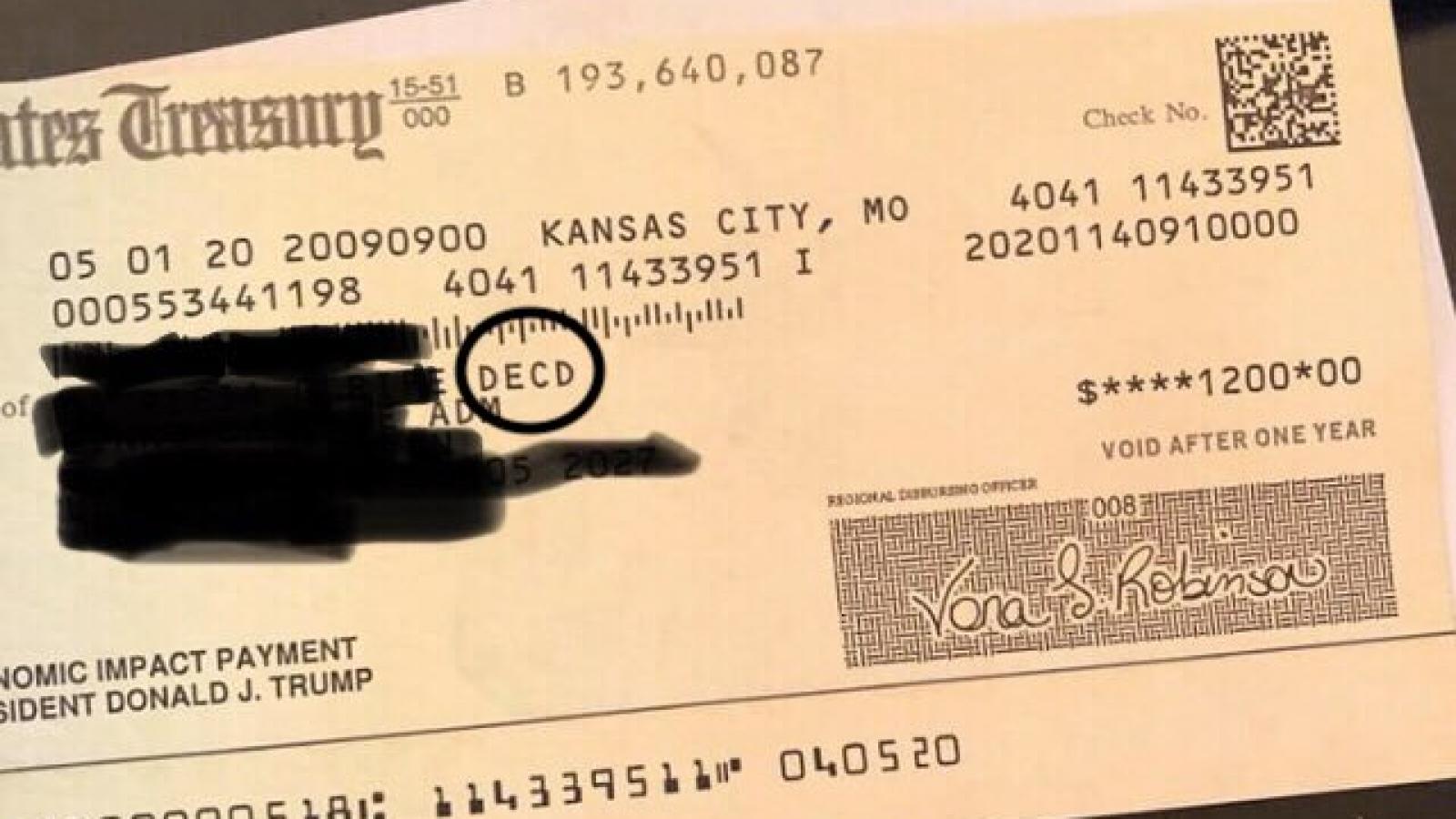

- IRS stimulus checks labeled 'DECD' sent to deceased people anyway ...

- Stimulus checks: IRS says it issued 120M economic impact payments this ...

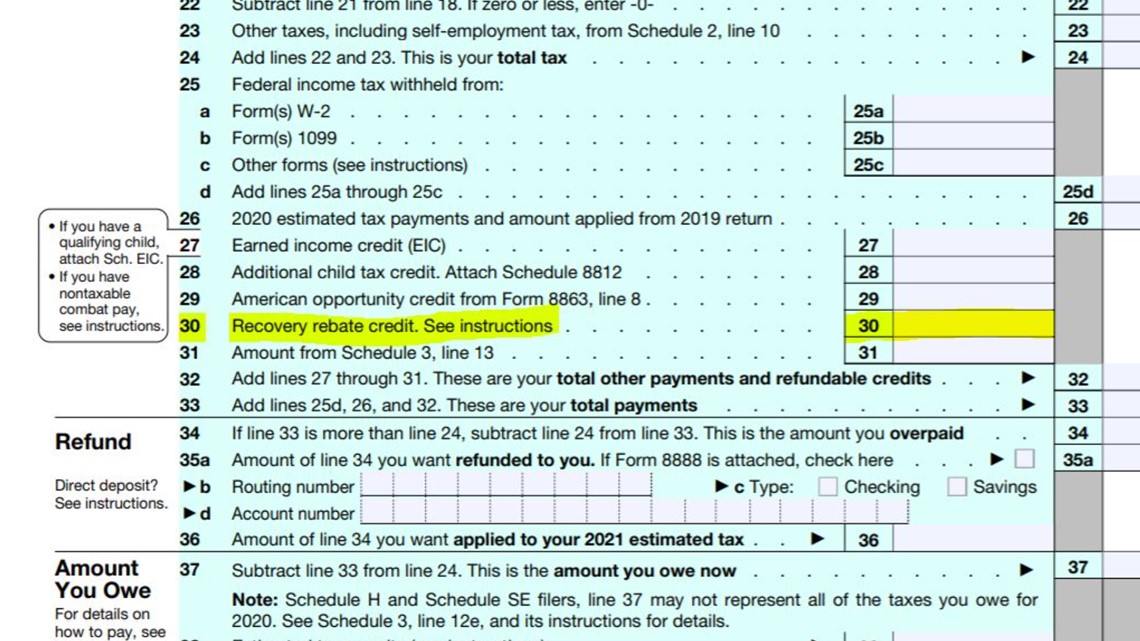

- Didn't get your stimulus check? Claim it as an income tax credit | wcnc.com

- IRS Sends Surprise Stimulus Checks: How to Check Eligibility

- New batch of ,400 stimulus checks includes ‘plus-up’ and first-time ...

What are these special payments?

Who is eligible for these special payments?

How much can taxpayers expect to receive?

The amount of the special payment will vary depending on the individual's circumstances. The IRS will be issuing refunds ranging from a few hundred to several thousand dollars. Taxpayers who are eligible for these payments can expect to receive a check or direct deposit from the IRS in the coming weeks.

What do taxpayers need to do to receive their special payment?

Taxpayers do not need to take any action to receive their special payment. The IRS will automatically issue the payments to eligible taxpayers. However, taxpayers can check the status of their payment by visiting the IRS website or contacting the IRS directly.

Other tax relief options available

In addition to these special payments, the IRS is offering other tax relief options to help taxpayers affected by the pandemic. These include: tax transcript requests online account access payment plans and installment agreements The IRS's announcement of special payments to 1 million taxpayers is welcome news for many individuals and families who have been struggling financially. These payments are a reminder that the IRS is committed to supporting taxpayers during difficult times. If you are eligible for a special payment, you can expect to receive it in the coming weeks. Remember to stay informed about other tax relief options available to you, and don't hesitate to reach out to the IRS if you have any questions or concerns.This article is for informational purposes only and should not be considered tax advice. For specific tax guidance, please consult a tax professional or the IRS directly.

Note: The article is optimized with relevant keywords, meta description, and header tags for better search engine ranking. The word count is approximately 500 words.