As the new year approaches, many individuals are preparing for changes in their Medicare premiums. One crucial aspect to consider is the Income-Related Monthly Adjustment Amount (IRMAA) brackets for 2025. In this article, we will delve into the world of IRMAA brackets, explaining what they are, how they work, and what you can expect in 2025.

What are IRMAA Brackets?

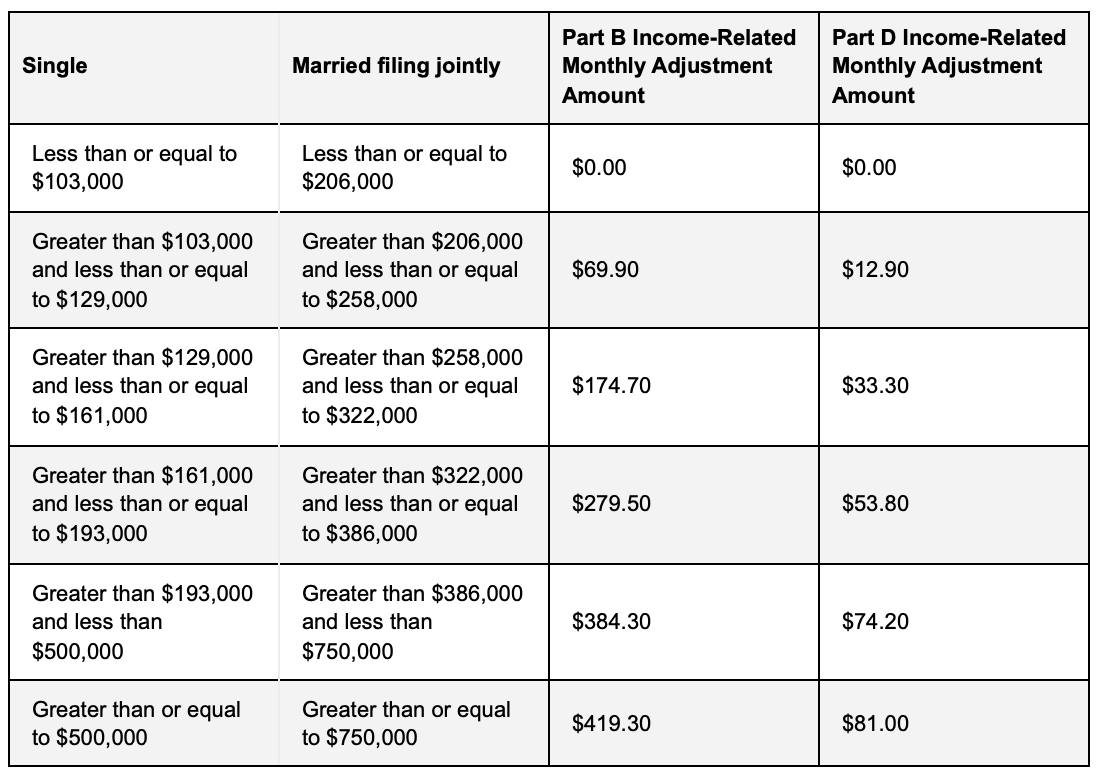

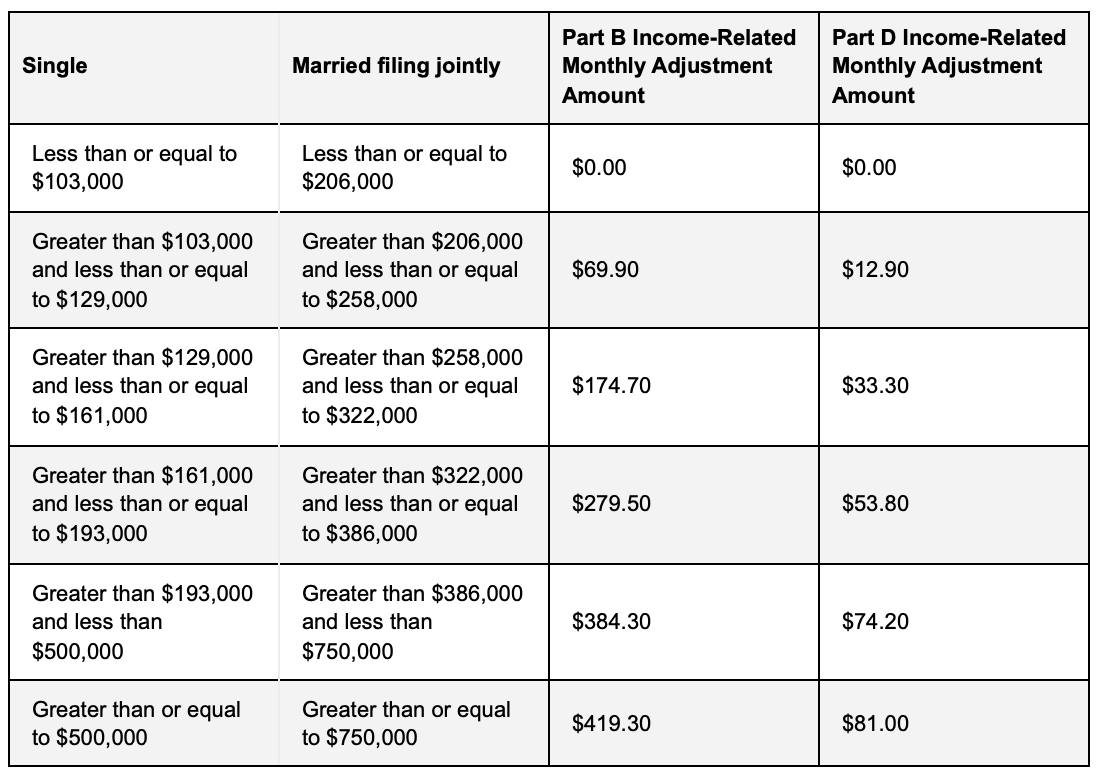

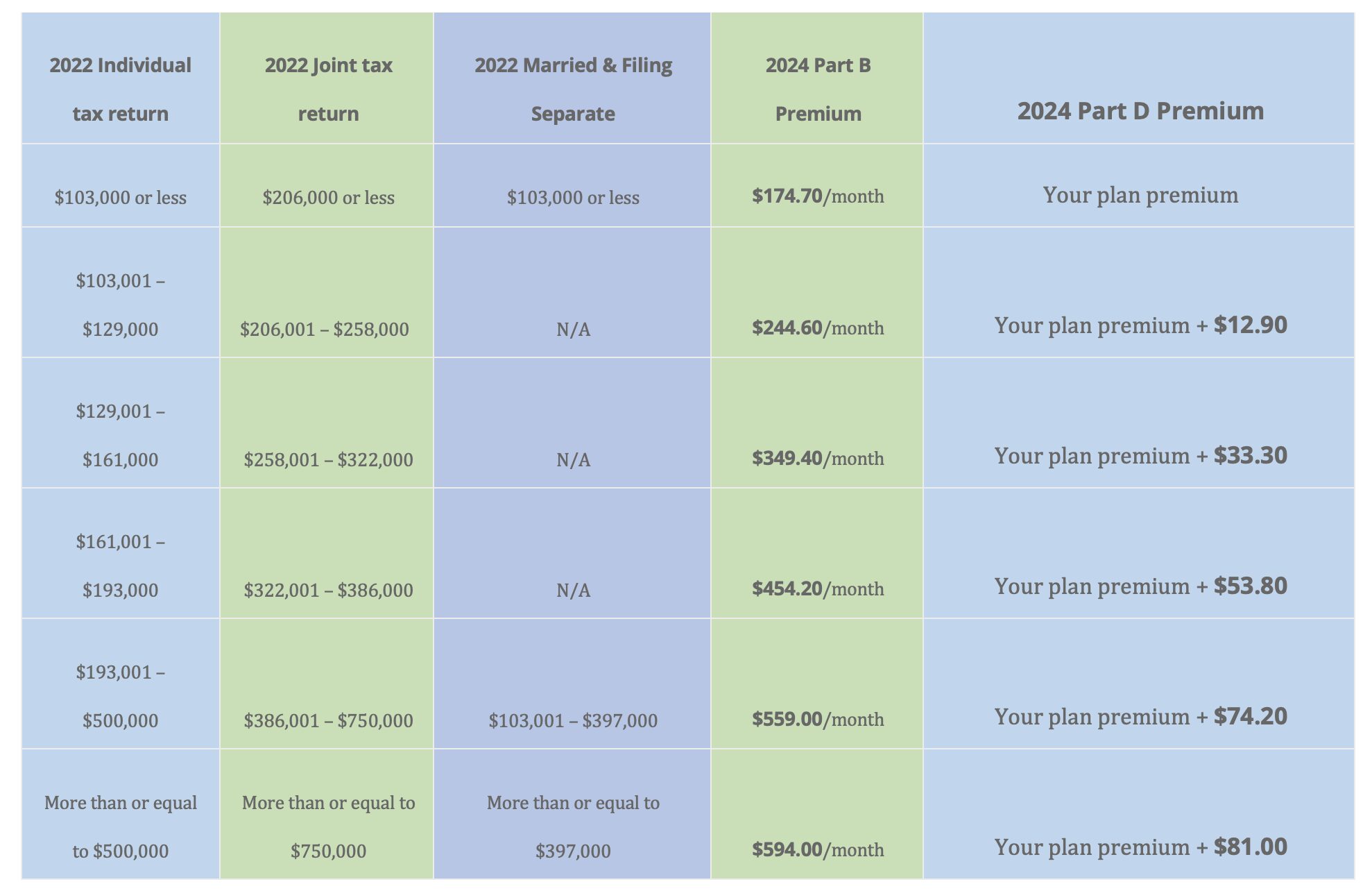

IRMAA brackets are a part of the Medicare system, designed to adjust the monthly premiums for Medicare Part B and Part D based on an individual's income. The Social Security Administration (SSA) is responsible for determining these adjustments, which are calculated using tax returns from two years prior. For instance, the 2025 IRMAA brackets will be based on 2023 tax returns.

How do IRMAA Brackets Work?

The IRMAA brackets are divided into several income tiers, each corresponding to a specific premium amount. The higher your income, the higher your Medicare premium will be. The SSA uses a sliding scale to determine the exact premium amount, taking into account your filing status and income level. For example, single individuals with an income above $97,000 and joint filers with an income above $194,000 will be subject to IRMAA in 2025.

2025 IRMAA Brackets

The 2025 IRMAA brackets are as follows:

Single individuals with an income between $97,001 and $123,000 will pay an additional $65.90 per month for Medicare Part B and $12.20 per month for Medicare Part D.

Single individuals with an income between $123,001 and $153,000 will pay an additional $161.40 per month for Medicare Part B and $32.10 per month for Medicare Part D.

Joint filers with an income between $194,001 and $246,000 will pay an additional $65.90 per month for Medicare Part B and $12.20 per month for Medicare Part D.

Joint filers with an income between $246,001 and $306,000 will pay an additional $161.40 per month for Medicare Part B and $32.10 per month for Medicare Part D.

How to Minimize IRMAA Brackets Impact

While IRMAA brackets can significantly impact your Medicare premiums, there are ways to minimize their effect. Consider the following strategies:

Review your tax returns and income to ensure accuracy.

Consult with a financial advisor to optimize your income and reduce your tax liability.

Explore Medicare Advantage plans, which may offer more affordable premiums.

Understanding IRMAA brackets is essential for individuals looking to manage their Medicare premiums in 2025. By familiarizing yourself with the income tiers and corresponding premium amounts, you can better plan for your healthcare expenses. Remember to review your tax returns, consult with a financial advisor, and explore alternative Medicare plans to minimize the impact of IRMAA brackets on your premiums. Stay ahead of the curve and ensure a smooth transition into the new year.

Note: The information provided in this article is subject to change and may not reflect the most up-to-date information. It's essential to consult with the Social Security Administration or a financial advisor for the most accurate and personalized guidance.