Table of Contents

- Income Tax Filing Date 2025 - Bette Sybilla

- Tax Extension Deadline 2025 - Quade Vacumm

- Business Tax Deadlines 2025: Corporations and LLCs

- Tax Due Date 2025 - Laura Olivia

- Tax Payment Deadline 2025 - Ardene Carlynn

- Tax Due Date 2025 - Laura Olivia

- Business Tax Deadlines 2025: Corporations and LLCs

- 2025年报税别拖拉,记住几个重要的截止日! | JKtax

- 2025 Tax Extension Deadline 2025 Olympics - Karen Smith

- Why CPA need Outsourcing Tax Preparation Services?

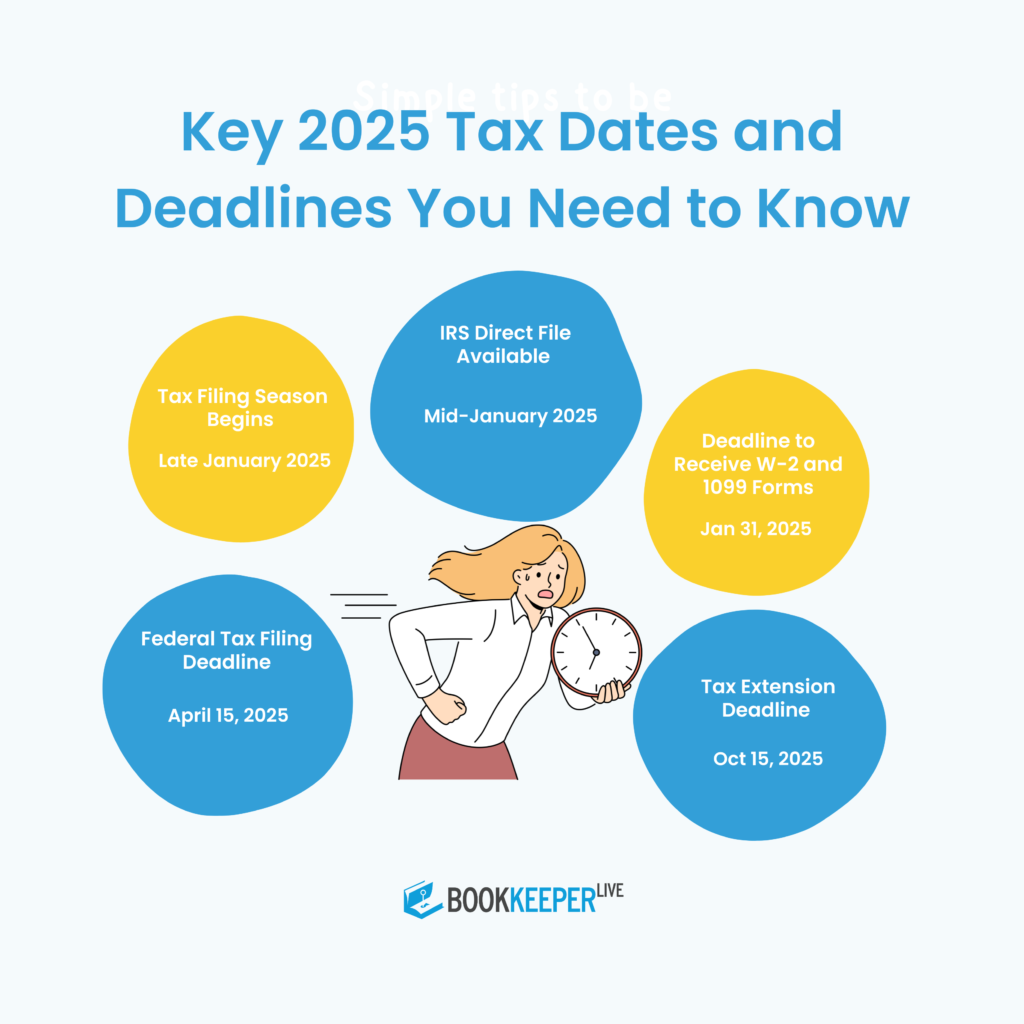

Individual Tax Filing Deadline

Estimated Tax Payments

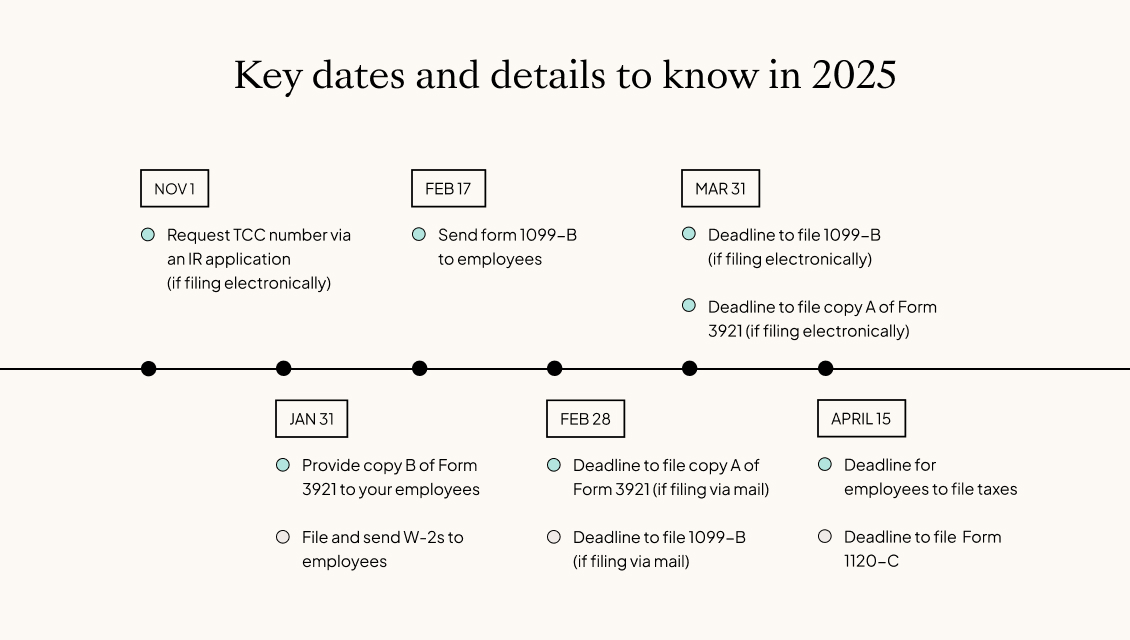

Business Tax Filing Deadlines

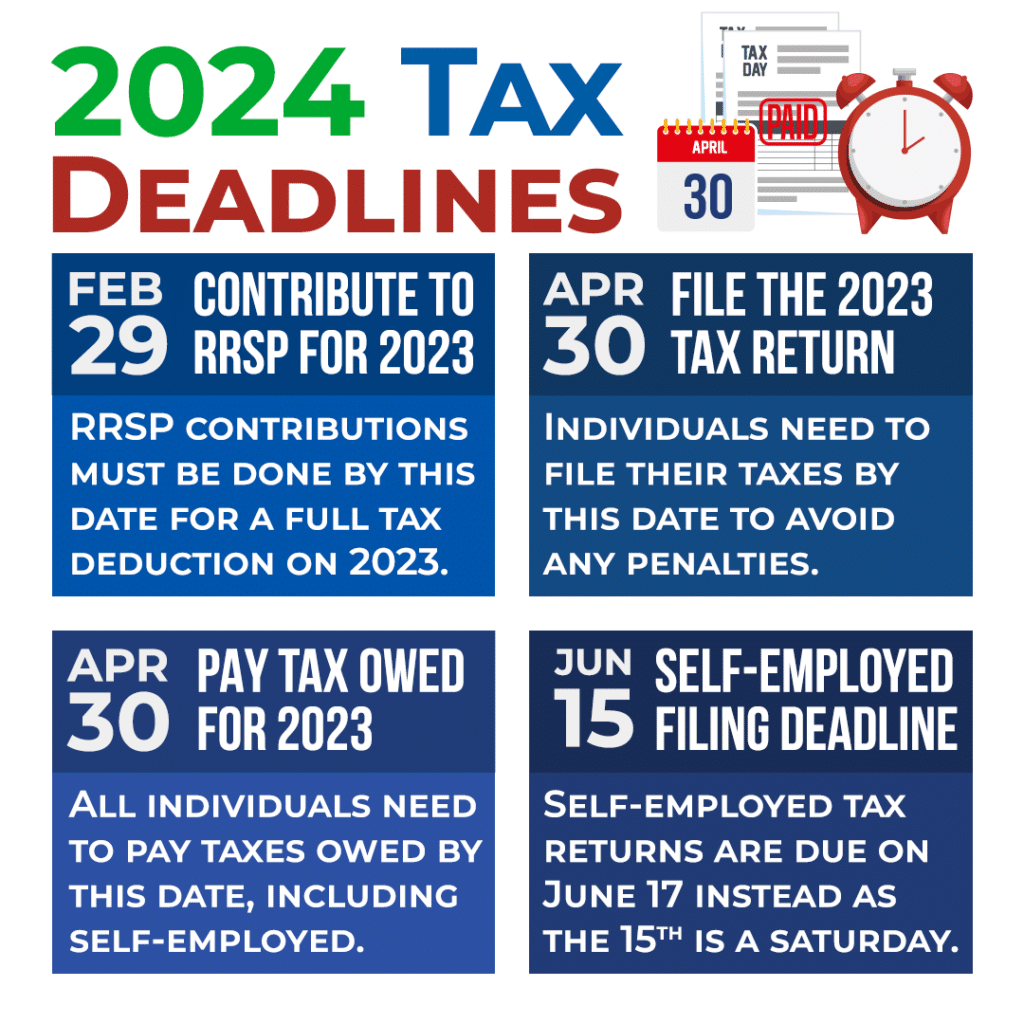

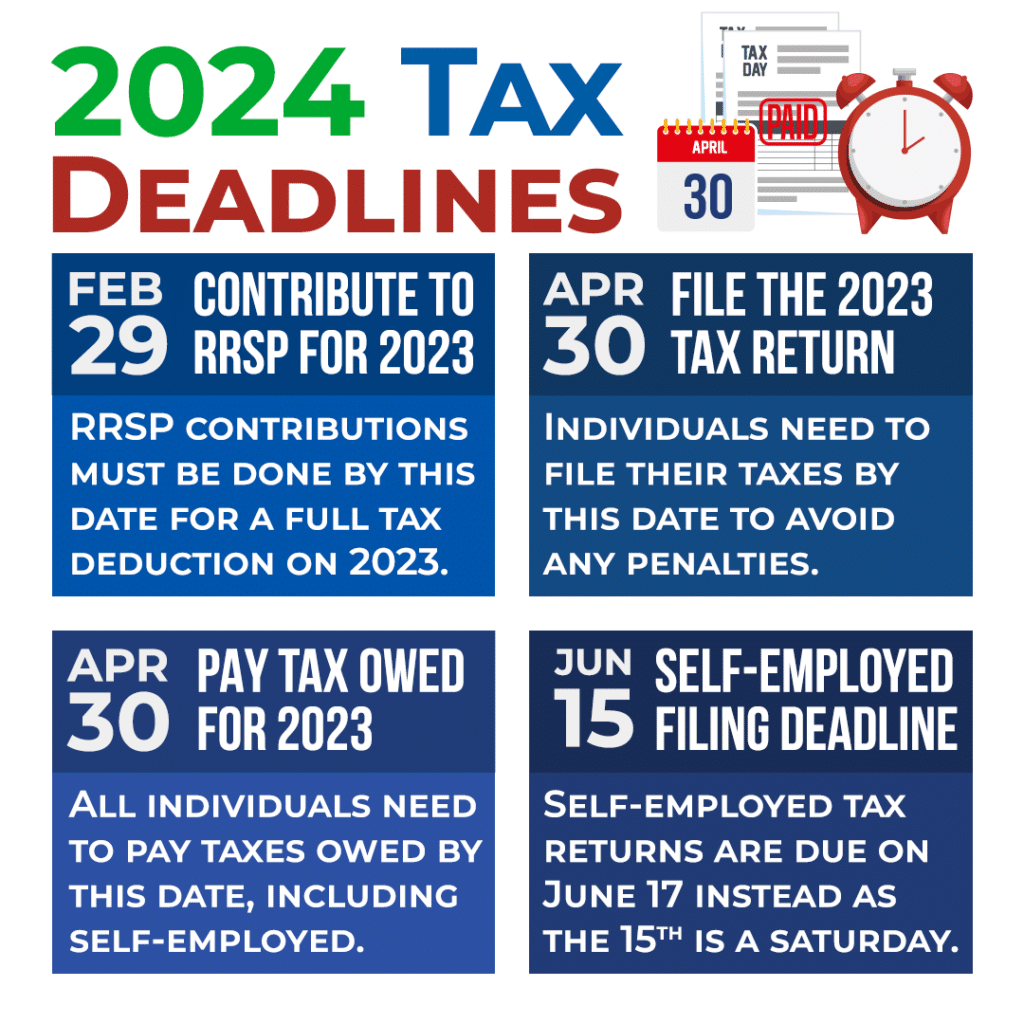

The tax filing deadlines for businesses vary depending on the type of business entity. Here are the deadlines for 2025: Partnerships (Form 1065): March 15, 2025 S Corporations (Form 1120S): March 15, 2025 C Corporations (Form 1120): April 15, 2025 Estates and Trusts (Form 1041): April 15, 2025 Staying on top of tax deadlines is crucial to avoid penalties and fines. By marking your calendar with the key dates outlined above, you'll be well-prepared for the 2025 tax season. Remember to file your individual tax return by April 15, 2025, and make estimated tax payments on a quarterly basis if required. If you're a business owner, be sure to file your tax return by the applicable deadline. If you're unsure about any aspect of the tax filing process, consider consulting with a tax professional to ensure you're in compliance with all tax laws and regulations.By understanding the tax deadlines for 2025, you'll be able to plan ahead and avoid any last-minute stress. Stay organized, and you'll be on your way to a smooth tax filing experience.

Key Takeaways: Individual tax filing deadline: April 15, 2025 Estimated tax payment due dates: April 15, 2025, June 16, 2025, September 15, 2025, and January 15, 2026 Business tax filing deadlines vary depending on the type of business entity Remember to check the IRS website for any updates or changes to the tax deadlines and regulations. Stay informed, and you'll be well-prepared for the 2025 tax season.